What was commonly regarded as great news for Klarna, ahead of what was suggested could be an amazing initial public offering (IPO), turned out to be a disaster for ride-hailing company Uber (NASDAQ:UBER), who made the deal to begin with. Uber dove over 4% in Wednesday afternoon’s trading after setting up the deal where Klarna users could pay for Uber services using the app.

Soon, users will be able to use Klarna as a payment option with Uber and Uber Eats, with users needing to only select the “Pay Now” option to instantly settle their order. Klarna can also be used to keep track of all payments made to Uber and Uber Eats, which can be particularly useful for those who need such records for tax purposes or the like. However, those who were hoping to pay for an Uber ride in installments won’t have such an option. That particular tool is out of bounds, limited only to the Pay Now tool.

Open Decline

The move isn’t doing much good for Uber, however, which is somewhat odd. After all, offering up a new payment option should, at least theoretically, make the service available to more users. However, Uber may still be struggling under the recent incident in Ohio, where an Uber driver was shot after a scammer sent said driver to an elderly man’s house.

The man in question, believing the driver was there to rob him, shot her. Throw in the potential of Tesla (NASDAQ:TSLA) entering the market with its robotaxi service, and suddenly, Uber faces negative public perception and a competitor with sophisticated technology in play at the same time.

Is Uber a Buy or Sell Right Now?

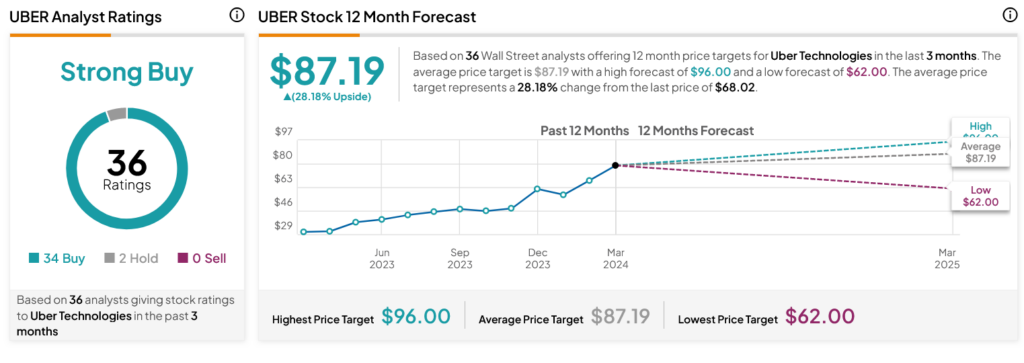

Turning to Wall Street, analysts have a Strong Buy consensus rating on UBER stock based on 34 Buys and two Holds assigned in the past three months, as indicated by the graphic below. After a 127.88% rally in its share price over the past year, the average UBER price target of $87.19 per share implies 28.18% upside potential.

Is It Wise to Allocate $1,000 Toward UBER Stock Right Now?

Before you hurry to invest in UBER, think about the following:

TipRanks’ team has built the Top Stocks Portfolio for investors, and UBER is not included. Our portfolio highlights companies that have been hand-picked for their potential to deliver significant gains in the years ahead.

See Top Stocks Model Portfolio >>