Tesla (NASDAQ:TSLA) seems to be increasingly focusing its efforts to expand its business in China, despite a decline in sales of China-made EVs for the EV giant in April.

The company sold 62,167 EVs manufactured in China in April, indicating an 18% decline year-over-year, according to data from the China Passenger Car Association (CPCA). Nonetheless, even as Tesla faces mounting competition from domestic players in China, CEO Elon Musk‘s surprise visit to the country last month has paved the way for the approval of its self-driving software rollout in China.

TSLA Proposes Testing ADAS in Robotaxis

According to reports in the Chinese media, Musk proposed testing the company’s advanced driver assistance system (ADAS) in China by deploying it in robotaxis. While Chinese officials welcomed TSLA’s testing of its ADAS software in robotaxis, they resisted Tesla’s widespread rollout of its Full Self-Driving (FSD) functions.

Moreover, the company requires approval from Chinese authorities to collect and transfer data for training its driver-assistance features before fully rolling out FSD. According to a Reuters report, the EV maker plans to apply for testing its ADAS system in robotaxis in Shanghai.

Tesla Sends Tom Zhu to China

Meanwhile, Musk is appointing his second-in-command at Tesla, Tom Zhu, as VP of its China operations, according to an Electrek report. Zhu had been leading Tesla’s successful operations in China, particularly its Shanghai Gigafactory, before being tasked with assuming an even larger role.

After Musk acquired X (formerly known as Twitter), he needed to dedicate more time to its operations at Twitter’s headquarters. As a result, Zhu was appointed to oversee TSLA’s North American sales, effectively becoming the primary leader of the company’s automotive business.

Now, according to the report, Musk has resumed direct oversight of TSLA’s operations in North America and has entrusted Zhu with leading the company’s operations in China once again.

Is Tesla a Buy or Sell?

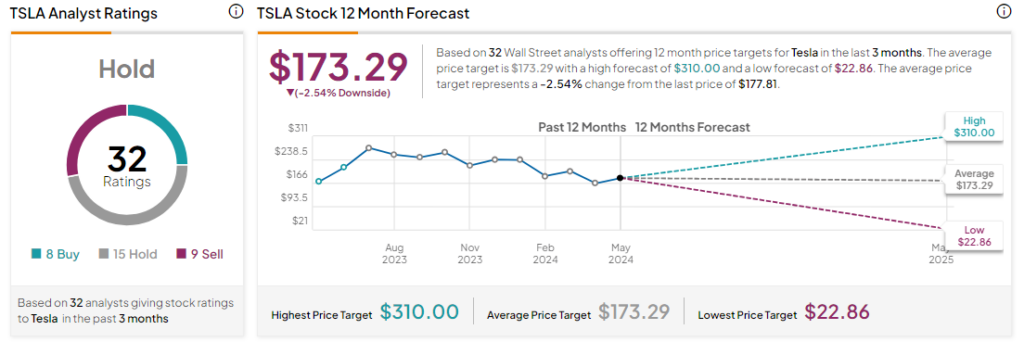

Analysts remain sidelined about TSLA stock, with a Hold consensus rating based on eight Buys, 15 Holds, and nine Sells. Year-to-date, TSLA has declined by more than 25%, and the average TSLA price target of $173.29 implies a downside potential of 2.5% from current levels.