Dividend Aristocrats are companies that have consistently increased their dividends for more than 25 years, making them a reliable and stable source of income for investors. Chevron (NYSE:CVX) and Sysco (NYSE:SYY) are two such stocks that not only boast an impressive dividend history but also have an upside potential of more than 15%. Furthermore, Wall Street analysts are bullish on these stocks.

Now, let’s take a closer look at these two Dividend Aristocrat stocks.

Chevron Corporation

Chevron is a multinational energy corporation that provides services in the oil, natural gas, and geothermal energy industries. The company has an impressive history of raising dividends for the past 37 years. Moreover, CVX stock offers a dividend yield of 3.88%, marginally above the energy sector average of 3.75%.

The company’s bottom line is expected to benefit from elevated crude oil prices. Furthermore, CVX’s strategic efforts to strengthen its productivity in the Guyana region with the acquisition of Hess Corp. (HES) are encouraging.

Is CVX a Buy, Sell, or Hold?

It is worth highlighting that since last week, six analysts have rated the stock a Buy. The bullish rating comes ahead of the company’s Q1 earnings report, scheduled for release on April 26.

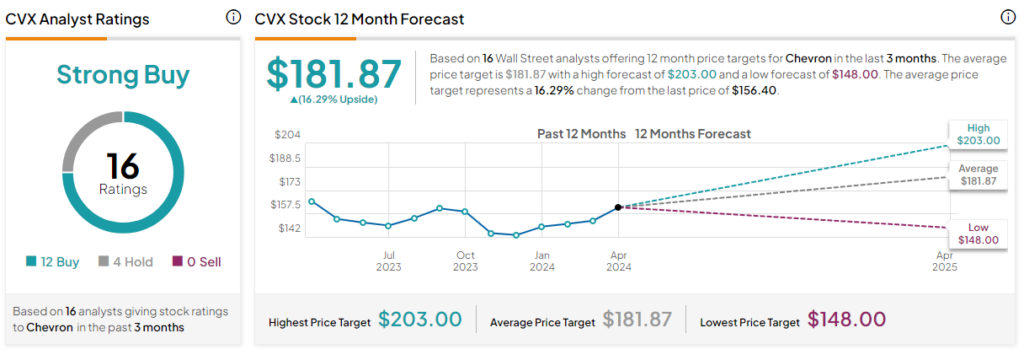

Among the 15 analysts covering CVX, 12 rated it a Buy, and four assigned a Hold rating. It has a Strong Buy consensus rating on TipRanks. The analysts’ average price target on Chevron stock of $181.87 implies a 16.3% potential upside from the current level. Shares of the company have gained 11.5% over the past three months.

It is worth mentioning that CVX stock carries a “Perfect 10” Smart Score on TipRanks. Interestingly, these stocks have historically outperformed the S&P 500 Index (SPX) by a wide margin.

Sysco Corporation

SYY provides a wide range of products and services to restaurants, healthcare facilities, educational institutions, and other customers. The company has raised dividends for 55 consecutive years. Additionally, its dividend yield of 2.45%, above the consumer defensive sector average of 2.13%, further enhances the stock’s appeal to investors.

The company’s vast network of distribution centers and efforts to grow business through acquisitions are expected to keep SYY well-poised for growth.

Is Sysco a Good Stock to Buy?

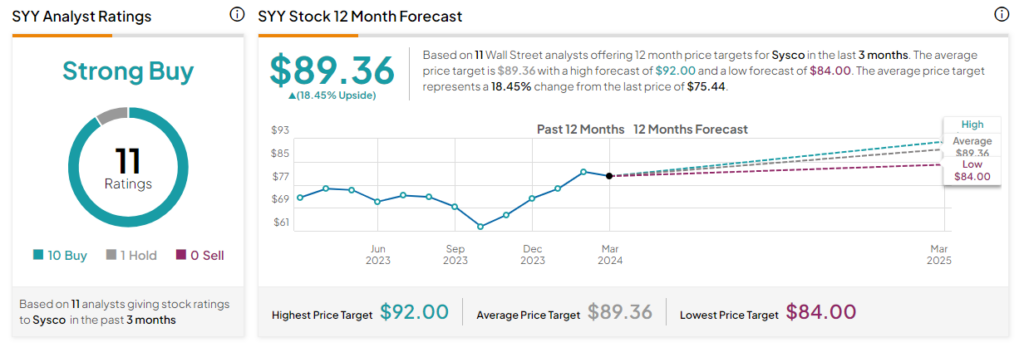

SYY has received 10 Buy and one Hold recommendations for a Strong Buy consensus rating. Further, analysts’ average price target on Sysco stock of $89.36 implies 18.45% upside potential. The stock has gained 16.5% over the past six months.

SYY has an Outperform Smart Score of eight on TipRanks.

Concluding Thoughts

CVX and SYY have strong dividend growth histories and robust business models. In addition, the potential for upside in the near term makes these companies worth considering by investors seeking consistent dividend income.