While most retailers are much less concerned about physical retail than they ever were—especially after 2020 revealed that the government can apparently cancel physical retail at any time it pleases—there are some who are taking a look at the concept in a brand new light. Foot Locker (NYSE:FL) is one such retailer, and its “store of the future” concept gave it a fractional boost in Wednesday afternoon’s trading.

Foot Locker is poised to bring this new concept to five cities right now, starting in Wayne, New York. Soon after, New York City will get such a store, followed by Paris, Melbourne, and Delhi. The new stores are said to be more “immersive,” including a “drop zone,” where the newest sneaker releases will be shown off.

A “sneaker hub” will feature shoe customization options, and brand product displays will be elevated to better attract attention. Meanwhile, the area where people can try on shoes will be a communal location. Foot Locker is even planning to revamp store uniforms to help breathe new life into the retail concept.

If You Build It, Will They Care?

It certainly sounds like an exciting proposition. A new store tends to draw interest while customers figure out if the store has what they want or not. And Foot Locker doesn’t look to disappoint on the product side, either. Just recently, the Jordan Tatum 2 “Legacy” line launched at Foot Locker, priced at $125. The Jordan Tatums are specifically geared around Boston Celtics star Jayson Tatum, and will, it’s hoped, pull more interest to Foot Locker and the Jordan line. However, that might be a tougher ask than expected; looking for $125 for shoes at a time when food and gas prices are climbing might not go over so well.

Is Foot Locker a Buy or Sell?

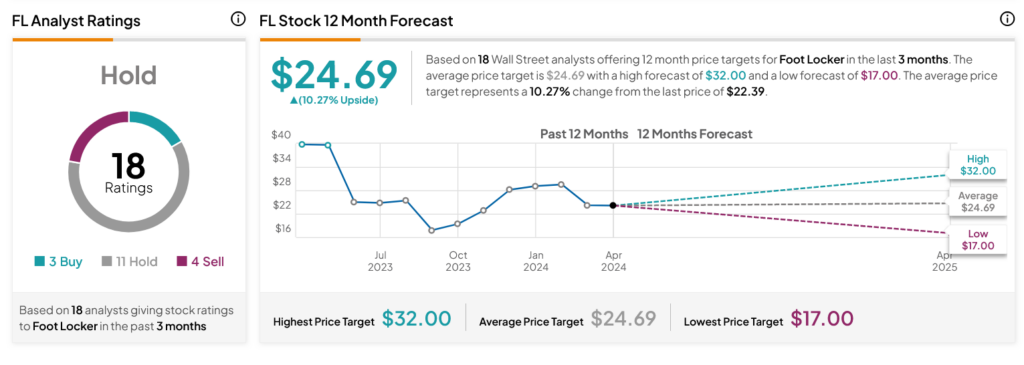

Turning to Wall Street, analysts have a Strong Buy consensus rating on FL stock based on three Buys, 11 Holds, and four Sells assigned in the past three months, as indicated by the graphic below. After a 43.48% loss in its share price over the past year, the average FL price target of $24.69 per share implies 10.27% upside potential.

Is It Wise to Allocate $1,000 Toward FL Stock Right Now?

Before you hurry to invest in FL, think about the following:

TipRanks’ team has built the Top Stocks Portfolio for investors, and Foot Locker is not included. Our portfolio highlights companies that have been hand-picked for their potential to deliver significant gains in the years ahead.

See Top Stocks Model Portfolio >>