Social media companies have been going public in recent years, betting on their combination of audience reach and advertising cachet to bring in profits and attract investors. The potential rewards are huge; according to Statista, the social media advertising spend should pass $300 billion this year, representing 11% year-over-year growth.

That’s a rich field of opportunity, and the social media companies are definitely jumping on it. The methods are varied; some companies are making investments in AI-powered advertising, while others are cashing in on notoriety and going public. All in all, social media has presented us with a rich field of targets for investment.

But not all social media stocks are created equal. Some are building high valuation on records of success, while others are dealing in hype – and a savvy investor will learn to tell the difference.

Enter Daniel Jones, a 5-star investor ranked in the top 3% of TipRanks’ stock experts, who has set his sights on two social media stocks generating headlines for widely different reasons.

Meta Platform (NASDAQ:META), the parent company of Facebook, is one of the tech world’s ‘Magnificent 7’ mega-cap stocks, and the Street’s most recent entry into the ‘trillion-dollar valuation’ club. Truth Social (NASDAQ:DJT) was the creation of former President Donald Trump, as an alternative to the pre-Elon Musk Twitter

Jones’ analysis leads to a clear conclusion on which of these names is the superior stock to buy. Let’s delve deeper.

Meta Platforms

We’ll start our look with social media giant Meta. As the parent company of Facebook, Meta boasts an impressive lineup including Instagram, Messenger, WhatsApp, and Threads, granting it access to a vast audience, spanning nearly half of the world’s population. Despite recent share price losses, Meta stands firm as the sixth largest publicly traded entity on Wall Street.

The recent share losses came after the company’s last earnings report, covering 1Q24. Meta reported gains at both the top and bottom lines – revenues came in at $36.46 billion for the quarter, growing 27% year-over-year and sliding in some $240 million over the forecast. The company reported GAAP earnings of $4.71 per share, beating the estimates by 39 cents.

The hit came when investors saw the company’s guidance numbers, which were considered weak. Looking at Q2, the company guided toward quarterly revenue in the range of $36.5 billion to $39 billion, a range whose midpoint came in below the consensus figure of $38.3 billion. At the same time, the company is predicting full-year 2024 capex in the range of $35 billion to $40 billion, up from the previous capex guidance range of $30 billion to $37 billion.

In Daniel Jones’ view, however, the important points to consider here, for the long term, are the growth potentials inherent in Meta’s business. He notes first that the company did report solid y/y growth in Q1, and that the guidance represents a slow-down, not a contraction.

Jones goes on to point out that Meta has plenty of growth initiatives on track, such as its new Threads platform, designed to compete directly with Elon Musk’s X, giving the company solid potential to maintain its growth.

“From all that I can tell, Meta Platforms is doing quite well. I understand that investors are unhappy with increased cost guidance. But when we look at how shares are currently priced, and we look at growth from initiatives such as Threads, it becomes clear to me that the stock’s upside is not over yet. To be clear, I do think the easy money has been made by this point. But I do think that additional upside that should exceed with the broader market will experience is warranted,” Jones opined.

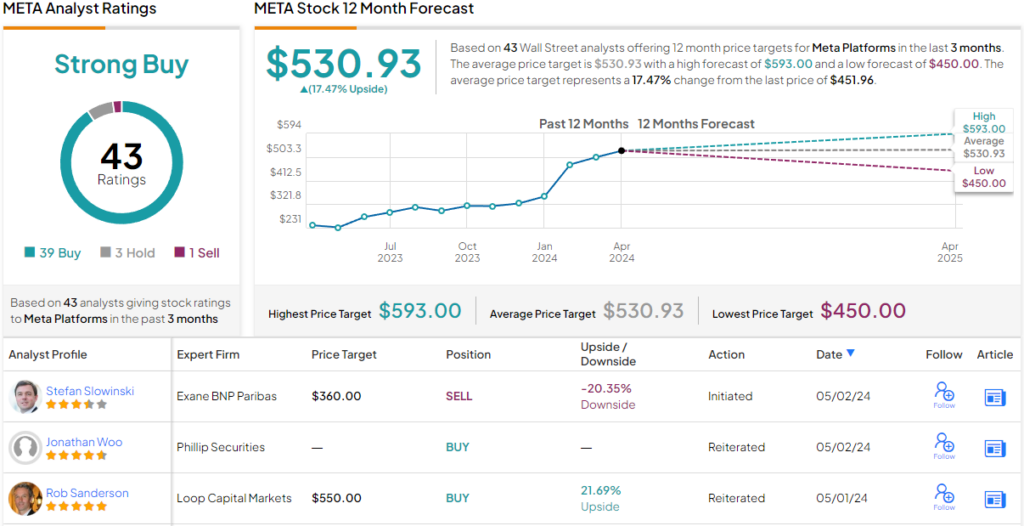

Jones concludes by urging investors to capitalize on Meta’s current position. This sentiment aligns with the broader analyst consensus, which rates Meta as a Strong Buy. Based on the Street’s $530.93 price target, the upside potential lands at 17.5% for the next 12 months. (See META stock forecast)

Truth Social

Next up is one of the social media field’s newer entries, Truth Social. Founded in October 2021 following former President Trump’s Twitter ban, Truth Social quickly gained recognition as an alternative social media platform – and became the go-to place for Trump’s social media audience.

Truth Social now competes with other alternative platforms such as Mastodon, Gab, and Parler. Yet, like its counterparts, it grapples with the uphill battle of building and retaining a user base, posing challenges for advertisers seeking to capitalize on these platforms.

That brings us to another point – Truth Social does not turn a profit. Trump has been less than transparent regarding the platform’s finances, but it’s no secret that it runs at a loss – and significant loss, being reported as $58.19 million in 2023.

This paints an interesting background to the company’s entry to the public trading markets. Truth Social went public just this past March, through a SPAC deal with Digital World Acquisition Corporation. The deal created a company with a market cap valuation of approximately $8 billion. Truth Social was valued that high even though, according to some estimates, it had only 5 million visitors that month, a figure that compares poorly to Meta’s 845 million monthly visitors, and Pinterest’s 250 million. Truth Social’s audience has been described as ‘very small, niche, and not very global,’ not an auspicious beginning for a social media platform aiming to become a major player.

Given all of this, it’s no wonder that DJT has been compared to ‘meme stocks.’ Shares in Truth Social have shown extreme volatility since going public, closing their first day at more than $61 per share, but falling as low as $22 in mid-April. The shares are currently priced at $48. It’s fair to say that DJT, in its short career on the public markets so far, has developed a reputation as one of the most volatile stocks on Wall Street.

The sobering reality for investors, as Daniel Jones points out, is that while it may seem opportune to enter DJT stock at what appears to be the bottom, that bottom may be much lower than anticipated.

“Based on my own assessments, even a generous view of the company suggests a fair value that is lower than $5 per share. And in all likelihood, the stock is worth even less than that in my opinion. Because of this unappealing picture, I have no choice but to rate the business a very ‘strong sell’ that I typically reserve for firms that are either drastically overvalued or that are on their way out of business,” Jones opined.

Jones is one of the few market experts to weigh in on Trump’s Truth Social since its public trading debut – and he’s even weighed in before the Wall Street analysts. The stock is currently priced at $47.93, and if it falls to Jones’ suggestion of $5, that would represent a massive downside of ~90%. (See DJT stock analysis)

For top investor Daniel Jones, the choice here is clear: Meta is the superior social media stock to buy.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.