When Palantir (NYSE:PLTR) released its Q4 results in early February, investors gave a nod of approval to the big data company’s display, buoyed by its excellent positioning as an AI-related play and sending shares higher in the aftermath.

Once considered the weak part of the business, the commercial division demonstrated remarkable growth, fueled by the expanding adoption of Palantir’s Artificial Intelligence Platform (AIP). Notably, in the U.S. market, commercial revenue grew by 70% year-over-year to $131 million.

With the company readying to report first-quarter 2024 results on Monday (May 6, after the close), might a repeat scenario play out?

That is a strong possibility, says investor Noah’s Arc Capital Management, who once again expects the AI theme to be front-and-center.

“I believe the upcoming earnings report is expected to show continued growth for Palantir, driven by the increasing demand for AIP and their Foundry software,” says the investor. “The company’s approach of showcasing AIP’s capabilities through workshops and customer conferences has been highly effective in acquiring new customers and expanding their client base.”

To market its Artificial Intelligence Platform (AIP), Palantir has conducted demo workshops for prospective clients. The company has organized more than 560 AIP workshops spanning 465 different organizations.

As consumers gain a clear understanding of how AIP can be applied and how it can directly enhance operations, Noah’s Arc expects a significant surge in demand for the product. “In fact,” says the investor, “the effects from these workshops can already be seen, helping boost the company’s commercial revenue streams to over $1 billion over the last twelve months.”

As outlined on the Q4 earnings call, the company closed 103 deals surpassing $1 million each during the quarter (with previous AIP engagements typically valued at $1 million each according to CEO Alex Karp). Making some calculations, Noah’s Arc notes that out of the 465 organizations they’ve collaborated with, it suggests an estimated success rate of around 24%.

On the assumption this close rate stays the same, and reckoning by previous growth rates that during this fiscal year alone there could be around 3250 companies that could get an AIP demo, Noah’s Arc anticipates Palantir will close 780 unaccounted deals over the coming year (24% of 3250), which could result in up to $780 million in additional revenue.

With excellent prospects to look forward to, then, ahead of the Q1 print, Noah’s Arc considers PLTR shares a Strong Buy. (To watch Noah’s Arc’s track record, click here)

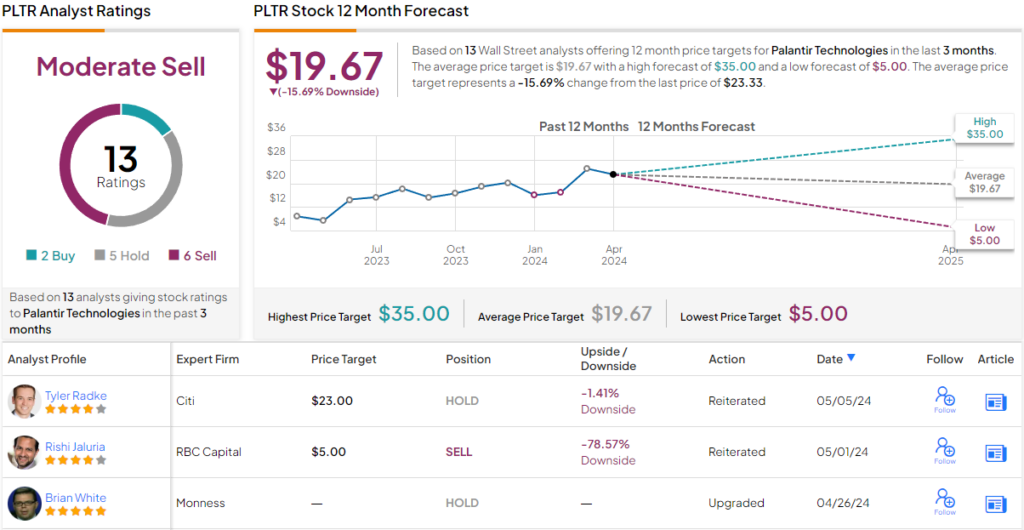

That’s one investor’s opinion, but the Street’s analyst corps have an entirely different take. Based on a mix of 6 Sells, 5 Holds and 2 Buys, the consensus view is that PLTR stock is a Moderate Sell. Moreover, the $19.67 average target factors in a 12-month decline of ~16% from current levels. (See Palantir stock forecast)

To find good ideas for AI stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.