Certain stocks, back around 2020, were known as “pandemic darlings.” These stocks were specially geared toward pandemic life, when people decided in large numbers to stay home, whether it was out of their own interest, government order, or some combination of the two. But with government order out of the picture now and people eager to get back to normal, many pandemic darlings are no longer what they once were and have accumulated huge losses from their peaks. Some are even down today:

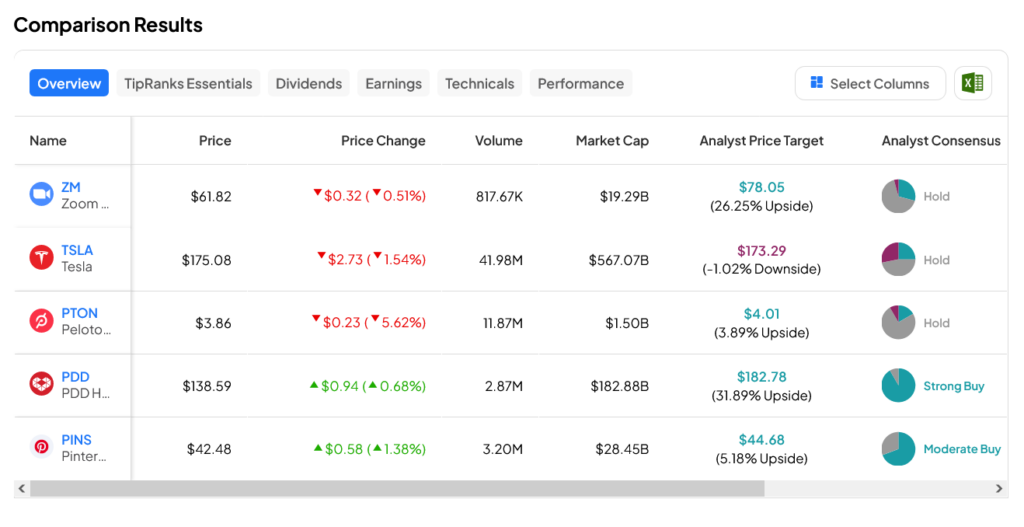

Zoom (NASDAQ:ZM) is down fractionally in today’s trading, while Tesla (NASDAQ:TSLA) fell around 1.5%. In addition, Peloton (NASDAQ:PTON) is hit hard once more, down over 5.5%. However, some, like Pinduoduo (NASDAQ:PDD) and Pinterest (NASDAQ:PINS) are up modestly in Wednesday morning’s trading.

While there have been some fluctuations in day-to-day value over the last few years—as should be expected with any stock, really—the pandemic darlings are not what they used to be. In fact, reports note that all told, the 50 leading pandemic darling stocks lost a combined total of about $1.5 trillion dollars in market value. To put that in perspective, that’s more money than the entire country of Mexico made in 2022.

Some of these companies are falling from higher places, too; for instance, Zoom shares went up about 765% in 2020 over their previous levels. But between then and now, it’s lost about 80% of its previous highs.

What Changed?

Sometimes the best rhetorical questions are the ones everyone knows the answer to already. What changed to turn so many of these stocks from golden to disaster was the market itself. Peloton, for example, had a great thing going when they found themselves in a market where going to the gym was forbidden by government mandate. So people invested in home gyms instead.

Peloton took that ball and ran with it so hard that it ended up leaving the stadium, ramping up its production as if people would keep buying like this forever. Of course, when gyms reopened, suddenly, a new Peloton wasn’t such a priority.

Which Pandemic Darlings Are Still a Good Buy?

Turning to Wall Street, the leader among pandemic darlings is PDD stock. This Strong Buy-rated stock offers a 31.89% upside potential on its average price target of $182.78 per share. Meanwhile, TSLA stock is the laggard among them, with a 1.02% downside risk against the average price target of $173.29.