Analysts remain bullish on a number of Australian stocks within interest rate sensitive sectors ahead of today’s expected rate hike, according to TipRanks insights.

The Reserve Bank of Australia (RBA) is predicted to raise its interest rate by as much as 0.50% today, in another attempt to weaken inflation. Investors remain on edge ahead of the RBA rate meeting, with the S&P/ASX 200 falling 0.3% on Monday.

However, TipRanks insights show analysts are bullish on some ASX shares within the Financials, Utilities, Real Estate, and Technology sectors – all of which are particularly sensitive to rate rises.

Analysts’ 3 favourite ASX financial shares amid rising RBA rates

The S&P/ASX 200 Financials (XFJ) index fell more than 0.3% on Monday. The index has retreated about 11% since the beginning of 2022. Increasing interest rates can boost profit margins for banks and other financial services companies that provide loans. However, a recession can send lenders reeling, as loan default risks increase. As a result, financial shares have seen volatile trading recently. Let’s take a look at three ASX financial stocks that are favourites among analysts now:

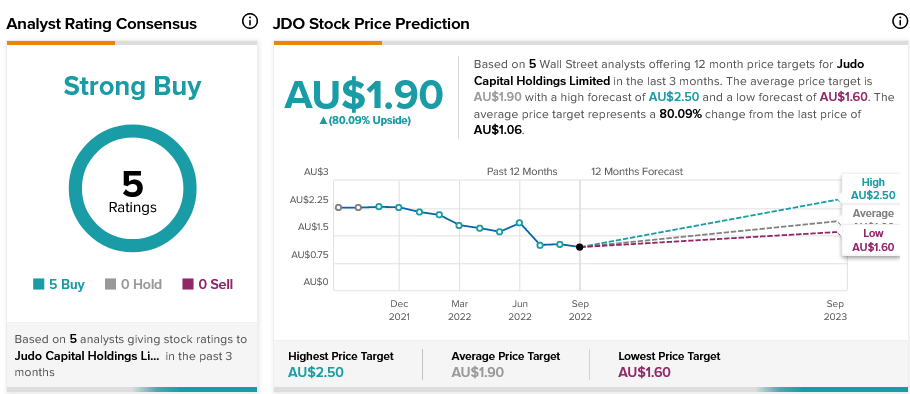

Judo Capital Holdings Limited (ASX:JDO)

According to TipRanks’ analyst rating consensus, Judo stock is a Strong Buy. The average Judo Capital share price forecast of AU$1.90 suggests over 80% upside potential. The stock is also a favourite with company insiders, who have purchased AU$556,900 worth of shares in the past three months.

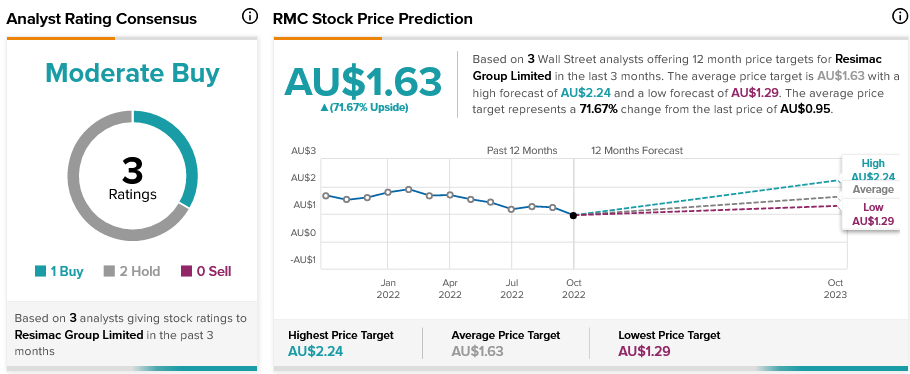

Resimac Group Limited (ASX:RMC)

According to TipRanks’ analyst rating consensus, Resimac stock is a Strong Buy. The average Resimac share price target of AU$1.63 indicates nearly 72% upside potential. Financial bloggers are also mostly bullish on Resimac shares.

Pepper Money Ltd (ASX:PPM)

According to TipRanks’ analyst rating consensus, Pepper Money stock is a Strong Buy. The average Pepper Money share price prediction of AU$2.11 implies almost 55% upside potential.

2 ASX utilities shares analysts are bullish on ahead of RBA rate meeting

The S&P/ASX 200 Utilities (XUJ) index rose about 1.6% on Monday. The index has been mostly stable amid the volatile trading, as it is down only 0.5% since the beginning of 2022.

Rising interest rates can help or hurt utility companies. For example, rising rates can increase borrowing cost for the companies. On the other hand, if rising rates help bring down inflation, then utility companies could see relief in operating costs and enjoy better profit margins.

AGL Energy Limited (ASX:AGL)

The Australian electricity provider serves both wholesale and retail customers. AGL Energy shares have gained about 12% year-to-date. According to TipRanks’ analyst rating consensus, AGL Energy stock is a Moderate Buy. The average AGL Energy price prediction of AU$8.57 implies over 25% upside potential.

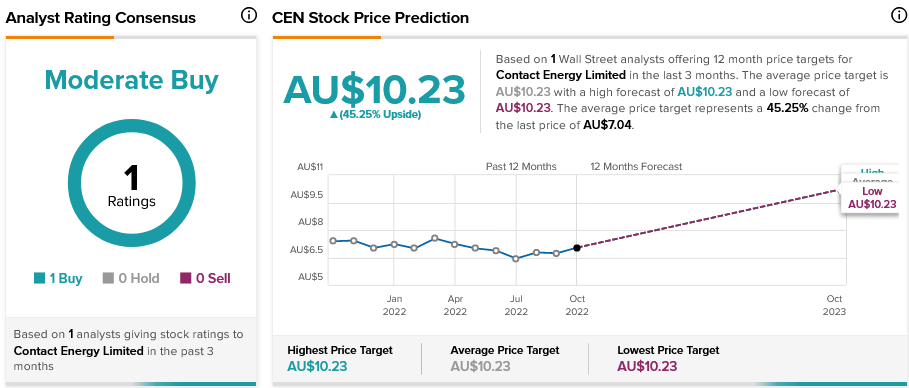

Contact Energy Limited (ASX:CEN)

The New Zealand electricity and gas company operates in wholesale and retail markets. Its shares have gained about 16% in the past three months, but they are down nearly 3% year-to-date.

According to TipRanks’ analyst rating consensus, Contact Energy stock is a Moderate Buy. The average Contact Energy share price target of AU$10.23 implies 45% upside potential.

3 ASX real estate shares analysts like amid rising interest rates

The S&P/ASX200 A-REIT (XPJ) index rose 0.8% on Monday, but the index is still down 30% year-to-date. Increasing interest rates can depress profit margins for REITs, pushing up borrowing costs for project funding. However, rising interests don’t always hurt REIT returns in the stock market.

Charter Hall Group (ASX:CHC)

Charter Hall Group shares give investors exposure to residential, office, retail, and industrial real estate property markets. The shares have gained about 3% over the past three months, but they are down more than 40% year-to-date.

According to TipRanks’ analyst rating consensus, Charter Hall Group stock is a Strong Buy. The average CHC share price prediction of AU$15.59 implies nearly 35% upside potential.

Centuria Industrial REIT (ASX:CIP)

Centuria shares give investors exposure to Australia’s industrial real estate market. The shares have declined about 34% since the beginning of 2022. According to TipRanks’ analyst rating consensus, Centuria Industrial REIT stock is a Strong Buy. The average Centuria Industrial REIT share price forecast of AU$3.51 implies over 34% upside potential.

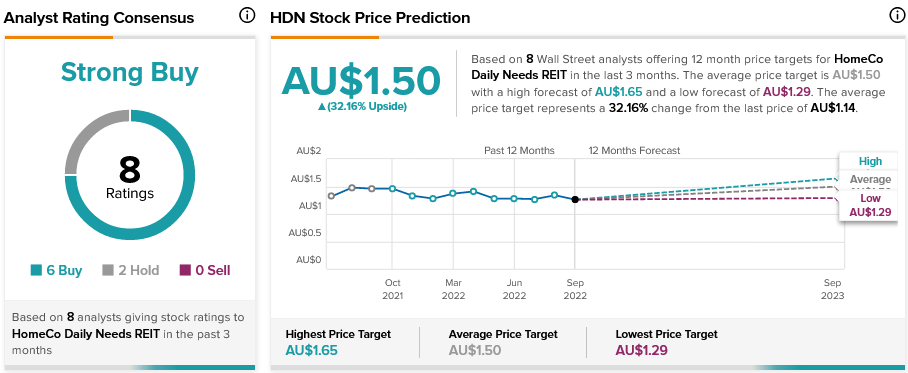

HomeCo Daily Needs REIT (ASX:HDN)

The company provides retail real estate spaces. Its shares have declined 23% year-to-date. According to TipRanks’ analyst rating consensus, HomeCo Daily Needs REIT stock is a Strong Buy. The average HDN share price target of AU$1.50 indicates more than 32% upside potential.

2 ASX technology shares analysts recommend as interest rates rise

The S&P/ASX 200 Information Technology (XIJ) index declined 1.33% on Monday. The index has dropped more than 30% year-to-date. Increasing interest rates can make raising additional capital more difficult and curtail sales for technology companies. However, analysts continue to like particular technology stocks amid rising RBA rates.

Xero Limited (ASX:XRO)

Xero provides small businesses with a range of technology solutions. Its shares have declined more than 50% year-to-date. According to TipRanks’ analyst rating consensus, Xero stock is a Strong Buy. The average Xero share price prediction of AU$99.91 suggests nearly 40% upside potential.

Nextdc Limited (ASX:NXT)

Nextdc runs a data centre business. Its shares have dropped 33% since the beginning of 2022. According to TipRanks’ analyst rating consensus, Nextdc stock is a Strong Buy. The average Nextdc share price target of AU$12.71 indicates over 46% upside potential.

Concluding remarks

While rate hikes can create volatility, the disruption also offers-up valuable opportunities. TipRanks insights can help investors with their share trading decisions, amid rising interest rates and the volatile market.